Future-proofing our business

RISKS AND OPPORTUNITIES

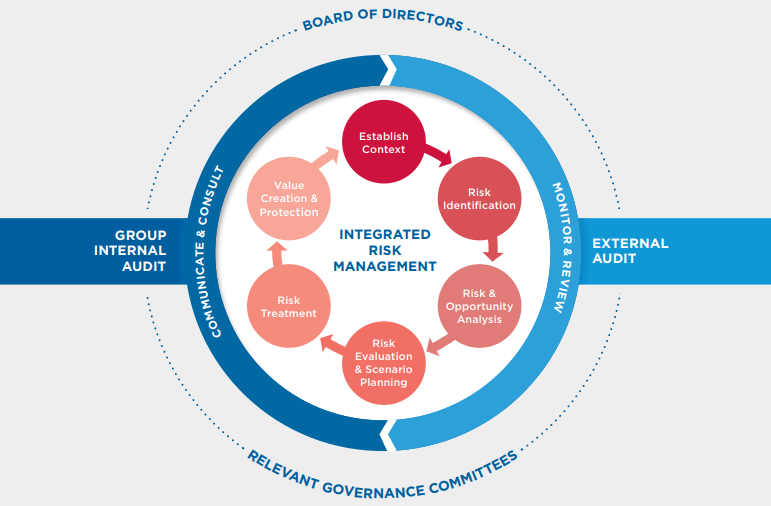

External context and internal operating environments continuously present our business with both risks and opportunities. We approach these risks and opportunities in an integrated, cohesive manner, which strives to not only deal with uncertainty in the external environment and minimise the downside exposure, but also seeks to capitalise on the upside potential to achieve our strategic objectives and execution. With that, we aim to fortify our Group as a resilient organisation that is able to create value now and in the future, by efficiently addressing environmental challenges while fully utilising market gaps.

AYO has a mature risk management framework that is aligned with the International Risk Management Standard and the requirements set out in South Africa’s King IV™ Governance Code. During the reporting period we further strengthened our internal audit function to enable swift identification and response to material risks in a standardised and systematic manner.

As an investment holding company, AYO is exposed to a broad range of risks, which arise both within our external environment and as a consequence of our business decisions and operations. The Board approves the Group’s risk profile, appetite and tolerance levels, which are set out in a formal Group Risk Charter. To ensure effective risk management oversight, each Board committee monitors relevant risks within the ambit of its scope.

The internal audit unit performs an independent objective assurance function on the adequacy and effectiveness of the Group’s governance mechanisms, risk management and internal controls. The external audit partner provides an audit opinion in accordance with all relevant prerequisites set out in the Companies Act, the JSE Listing Requirements and the King IV™ Governance Code. They work closely with the audit and risk committee, providing advice on financial reporting, tax and business issues and make recommendations to management to improve internal controls and process efficiencies to add further value to the Company.

Critical risks are identified by consistently monitoring the external and internal operating environment and taking into account implementation of mitigation and management strategies. This provides the Executive Committee and the Board with a robust assessment of the principal risks facing the Group and informs the selection of the appropriate risk treatment. The top 10 principal risks, as identified through the risk management process, are charted in the Group’s risk rating matrix, in terms of the severity of impact and likelihood of occurrence, reflecting the rate at which the Group will experience adverse impacts if the risk materialised. The risk appetite and tolerance for each principal risk is reviewed and approved by the Board to enable optimal informed risk-based decision-making.