Remuneration committee report

Dear Stakeholder,

I am delighted to present to you the remuneration committee report for the 2020 financial year. The report highlights the key outcomes of the committee’s deliberations in its formal meetings and the main components of AYO’s remuneration policy and philosophy, as well as illustrates how the policy was implemented to promote value creation and the achievement of the Group’s strategic objectives.

The remuneration committee, as mandated by the Board, is the custodian of AYO’s remuneration policy, its remuneration to non-executive directors and incentives for executive directors and key staff. We are also responsible for establishing a standardised approach to fair and transparent policies as well as guiding principles for the application of remuneration practices across the Group. We seek to ensure that total remuneration is externally competitive to attract, motivate and retain skilled resources, while also aligned with the organisation’s strategic objectives, stakeholders’ expectations and shareholders’ interests.

The committee held three formal meetings during the reporting period, enjoying high attendance and engagement of directors and invited executives. In those meetings we reviewed and updated AYO’s remuneration policy in the context of the latest market trends and the Company’s target deliverables and also reviewed the annual remuneration of staff members across all levels of the organisation.

REWARD PHILOSOPHY

AYO recognises and acknowledges the important impact of the human factor on a company’s ability to achieve its strategic objectives and long-term sustainable value creation. This is particularly relevant within the ICT sector, where critical skills are rare, sought-after and mobile. Thus, the Group’s remuneration philosophy is anchored in the King IV™ Code principle of Total Rewards striving to provide a holistic, attractive employee value proposition including monetary and non-monetary compensation, which attracts, engages, motivates, develops and retains the top talent available in the marketplace. To achieve this, AYO deliberately integrates five key elements in its employee rewards proposition, namely career opportunities, growth and recognition; alignment of personal and Company culture and values; competitive compensation; attractive benefits; and safe, healthy and pleasant work environment. This allows us to leverage the proper mix of rewards to satisfy personal and financial needs of our employees, given our business environment, operating context and affordability constraints. The ultimate aim is to ensure that AYO is able to develop, motivate and maintain a robust talent pipeline that enables our business growth and continuity.

AMENDMENTS TO THE REMUNERATION POLICY

AYO’s Remuneration Policy is a “working document”, continuously evolving and fine-tuning to ensure alignment with new effective legislation, relevant King IV™ governance principles, industry best practices and employees’ and shareholders’ interests. There has been 66.26% support for the tabled remuneration policy and implementation report at the 2020 Annual General Meeting. The committee engaged with policy precluding shareholders but received no further input from them and consulted external benchmarks to amend the policy to better meet the needs of all stakeholders. We are confident of the fact that AYO’s remuneration policy is prepared in accordance with industry best practices and governance as contained in the King IV™ Code on Corporate Governance, we comply with applicable legislation, including but not limited to the Companies Act 71 of 2008 (as amended). It has been developed in consultation with Top Executive Survey and Execeval™ system of Deloitte, particularly in the determination of executive remuneration, and within the context of AYO’s business requirements and objectives. A thorough assessment of the remuneration philosophy, policies and practices of the top ten JSE-listed ICT companies further informed the formulation of the document. Together with the committee’s implementation report, it will be presented to shareholders for a separate non-binding advisory vote at the Company’s next Annual General Meeting. In the event that less than 75% support is achieved for either the policy or the implementation report at the AGM, AYO will again invite dissenting shareholders to submit reasons for such votes in writing and schedule further engagement thereafter.

Remuneration comprises of a total guaranteed package, bonus payments, short-term and long-term incentives.

TOTAL GUARANTEED PACKAGE (TGP)

TGP is AYO’s guaranteed pay to all its employees and is calculated on the total cost-to-company basis, inclusive of Company’s contributions for selected benefits. The TGP is increased in September each year with consideration of the official Consumer Price Index, internal and external benchmarks, the Company’s performance and affordability. An increase of 7% of TGP, as approved by the Board at the end of the previous reporting period, was successfully implemented with effect from 1 September 2019. With the economic disruption caused by the COVID-19 pandemic and lockdown, the Group implemented a temporary salary reduction of 20% for all executive directors and staff for the period May to July 2020. Full TGP allocations were reinstated with effect from 1 August 2020 and the committee has recommended an annual increase of 5% of TGP to the Board for the next financial year.

BONUS PAYMENTS

A bonus payment equivalent to one month’s TGP is paid to all staff in the employ of the Company on an annual basis. The award of this discretionary bonus is recommended by the remuneration committee and serves to recognise, reward and motivate employees to continue to display motivation and diligence to promote the strategic objectives of the business.

SHORT-TERM INCENTIVES (STI)

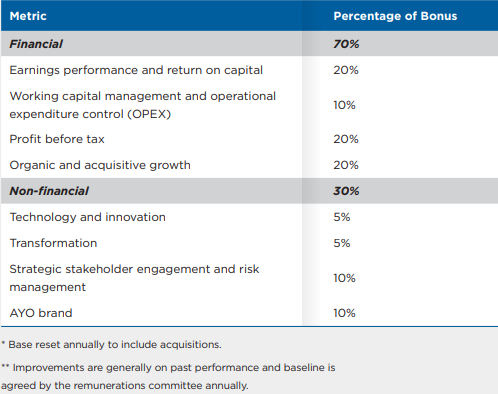

STI is essentially a performance bonus, designed to incentivise management to drive business performance in order to increase shareholder value. This annual incentive is awarded discretionary, based on the individual’s performance throughout the year in respect of both company and rolespecific financial and non-financial metrics. Targets are set in respect of profit growth, return on average net assets, operational efficiency, strategic stakeholder engagement and risk management. Performance is measured against contribution towards the attainment of targets within its relevant weighting per discipline . Given the maturity of our business and the Company’s specific operating context and challenges, these factors are deemed to be appropriate measures of the business and individual performance.

The STI targets are determined by the committee, agreed with the executive team and senior management and thereafter approved by the Board. The targets have been set reasonably high to encourage problem-solving and initiative, while the weightings of the various metrics aim to promote collaboration and teamwork. A hurdle rate of average monthly core inflation (as published) is set and must be achieved prior to target metrics, before the allocation of STI is considered.

GROUP TARGETS:

Specific threshold, target and stretch target levels have been defined for each metric. Below the threshold, no STI is achieved. Based on the performance, a score is calculated linearly between the threshold and on target or between the on target and stretch target.

A maximum attainable level of 150% of TGP can be reached under the incentive with the Board having the authority to extend the bonus cap to 250% of annual TGP. This can only occur if there is exceptional growth in profits, retaining market position despite unusual trading and perception complexities. Notwithstanding the attainment of good business performance, unsatisfactory individual performance automatically disqualifies a person from being considered for STI in the year under review.

LONG-TERM INCENTIVES (LTI)

LTIs are compensation schemes that, in addition to fixed pay and STIs, are designed to reward performance based on the achievement of the Group’s long-term financial goals and aligning the interests of management with those of shareholders. Traditionally, LTIs are awarded at a certain date within a financial year but only paid to an employee after a period of two years. Thus, they serve as a retention policy for a company’s key executives.

A new LTI compensation scheme has been drafted during the reporting period to enable attraction and importantly, retention of key management over the long term – at least five years. The scheme proposes that a proportion of the shares vest to employees annually, in order to keep employees productively engaged for the duration of the period. It is envisioned that the new scheme will be proposed to the Board for review in the next reporting period.

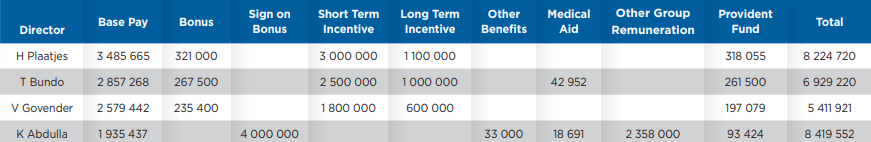

EXECUTIVE DIRECTORS’ REMUNERATION

AYO’s executive directors are employees and hold standard employment contracts with the Company. Their basic remuneration package is determined by the nominations committee at the time of their appointment. The decision is informed by two market benchmarks and occasionally, the services of an independent senior remuneration consultant are also utilised to guide the committee on market movements and trends in the executive remuneration landscape.

NON-EXECUTIVE DIRECTORS’ FEES

Non-executive directors are not employees of the Company and thus, do not participate or benefit from the Company’s performance schemes and incentives. They are paid set fees for participating in and attending Board meetings as well as for their participation and input in the affairs of the various Board committees.

The determination of non-executive directors’ fees is influenced by various factors, including but not limited to the SA Guide to Executive Remuneration and Reward national survey and industry market rates, relative size and complexity of the organisation, individual responsibilities and accountability, estimated time required for preparation and attendance of meetings, relevant experience and specialist knowledge. No arrangements exist for compensation in respect of loss of office. The fee structure is reviewed annually by the Board and disclosed in the remuneration report as prescribed in section 30(4) of the Companies Act.

AYO non-executive directors’ fees for 2020 financial year

APPRECIATION AND FORWARD FOCUS

I am particularly grateful to the members of the committee for their dedication, valuable contributions and consistent engagement during this disrupted period. I am satisfied that we have fulfilled our mandate and complied with our obligations and statutory functions as outlined in the committee charter, as well as duties assigned by the Board.

We look forward to further engaging with shareholders and all relevant stakeholders in the next reporting period on matters relating to the Group’s remuneration and rewards practices. We will persist to review and update our remuneration policy and designed incentives to ensure their continual relevance and competitiveness, facilitate the tabling, approval and implementation of proposed amendments and oversee and enhance our employee value proposition for the achievement of AYO’s strategic goals.

Aziza Amod

Chair of Remuneration Committee

22 December 2020

SOCIAL, ETHICS AND TRANSFORMATION COMMITTEE MEETING STATISTICS

Full remuneration report is available on our Group website at www.ayotsl.com. The report, as well as the remuneration policy, will also be presented at the next Annual General Meeting and I will be available to answer any questions regarding the policy, implementation and the activities of the committee.